Payroll Services

We can make your payroll process a smooth, convenient and hassle-free experience. With the new IRS laws, paying your employees has become more difficult than before. Allow us to take this time-consuming task off your hands. You will have more time to do what matters most – running a successful business.

On average a small business spends 8 hours a month performing payroll functions. That’s 12 full days a year! You could use this time towards your business:

- Produce sales

- Prospect new business opportunities

- Improve products or services

- Tend to your customers

Contact us today to set up a consultation and find the best way we can fulfill your business needs.

Why Outsource Your Payroll…

It’s Cost Effective

Reduce overhead by removing the need to hire specialized employees. Allow us to take this task on for you.

It’s a Time Saver

Our services take the weight off your shoulders. Stop customizing, updating, and maintaining your own payroll system. No more data entry or researching updates and new laws. No more worries!

Worry Free Payroll Tax Filing

Eliminate any chance of error due to miscalculation. Avoid this risk by having professionals do it for you. Federal, state and local payroll tax laws are evolving and becoming more complex. How much time do you want to spend learning new rules and keeping your information up to date?

Allows You To Focus On Core Competencies

Our professional staff allow you to focus on the core competencies of your business. We are accounting professionals. You get the experts working for you and with you!

Interested in Tax Legacy Advisors' Services?

Get the Payroll Solution That Best Fits Your Needs.

We know that when it comes to payroll service – no one size fits all. That’s why we offer the following 3 custom processing options.

1. Comprehensive Payroll Services

Our Comprehensive Payroll Service takes care of processing for you, so that you won’t have to. You get:

- Your payroll checks prepared and printed on-time, every-time

- Payroll checks laser printed on “blank” check stock. This ensures maximum security and meets the Federal Reserve System’s micro encoding standards

- Free Direct Deposits

- Worry Free IRS and State tax reporting as well as EFTPS tax deposits

- Easy to understand monthly, quarterly, and annual payroll tax reports. These include W-2, W-3 and 1099 forms

- Detailed reports on your employee’s vacation, sick days, and personal days accruals

- Creation and filing of the required new hire reports

- Your payroll records maintained in tip top shape

2. After-the-Fact-Payroll Services

We take your manually-prepared payroll records and other payroll information. We will post this information to our data files, so you get:

- Worry Free IRS and State tax reporting

- EFTPS tax deposits

- Easy to understand monthly, quarterly, and annual payroll tax reports. These include W-2, W-3 and 1099 forms

- Detailed reports on your employee’s vacation, sick days, and personal days accruals

- Creation and filing of the required new hire reports

- Your payroll records maintained in tip top shape

3. Online Payroll Processing

You can enter your employee’s hours and earnings securely online and get:

- The ability to instantly print payroll checks on your printer

- Free Direct Deposits

- Worry-Free IRS and State tax reporting as well as EFTPS tax deposits

- User-friendly and easy-to-understand reports

- Monthly, quarterly, and annual payroll tax reports

- W-2, W-3, and 1099 forms

- Detailed reports on your employee’s vacation, sick days, and personal days accruals

- Creation and filing of the required new hire reports

- Your payroll records are maintained in tip-top shape.

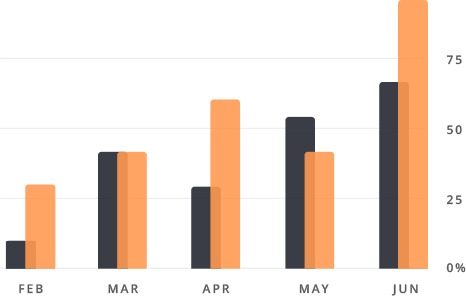

75

marketing analysis

65

business innovation

90

finance strategy

“I cannot give you the formula for success, but I can give you the formula for failure. It is: Try to please everybody.” david oswald

Business Planning & Strategy

Nurture promoters, your loyal customers who are more profitable and will advocate for your business—both in good times and bad.

Customer-focused businesses build a virtuous cycle we call the “customer wheel.” We help you at every stage of growth, developing custom solutions and collaborating with all levels of your organization. Identify quick, targeted customized solutions and operational improvements.

Visit Us Daily

Saint Cloud, Florida 34771

Have Any Questions?

(407) 954-9366

Mail Us

Taxes@taxlegacyadvisors.com

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.